Use our rate estimator to calculate approximate cost of in-home care. This number will help you to budget for the cost of care but we also recommend you look into the public and private benefit options to off-set the expenses if possible.

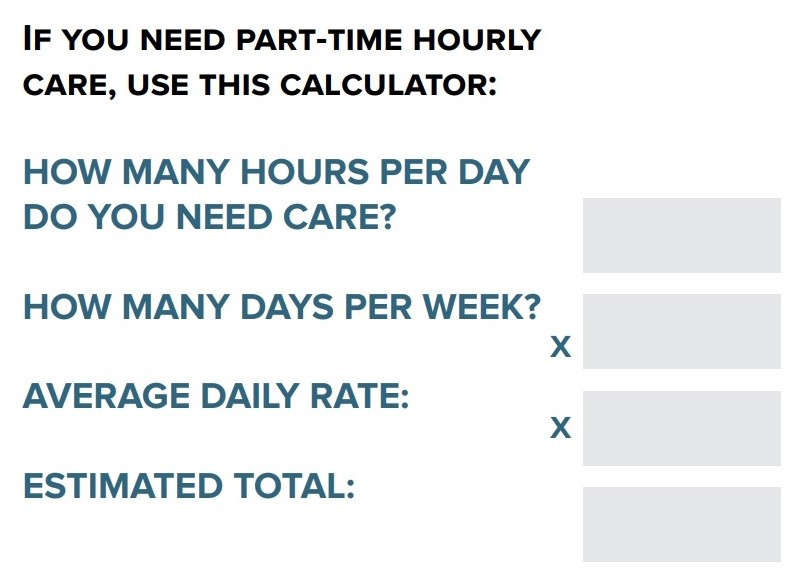

Calculating Part-time Hourly Caregiving Costs

To calculate the costs of hiring a part-time hourly caregiver, you’ll need to know:

- How many hours per day do you need care?

- How many days per week?

- Average daily rate

Calculating Live-In Care or Long-Term Assistance Caregiving Costs

To calculate the costs of live-in care or long-term assistance, you just need to know:

- How many days per month do you need care?

- Average daily cost

For context, below are hourly and overnight rates in our current markets as of July 2020 (rates subject to change based on needs and circumstances of the client):

| State | Metro Area | Hourly | Live-In |

| CA | Bay Area | $34 – $45 | $650 – $725 |

| CA | Sacramento | $29 – $40 | $610 – $650 |

| CA | San Diego | $28 – $34 | $575 – $625 |

| OR | Portland | $28 – $36 | $575 – $625 |

Options to Help Cover the Cost of Home Care

- Long-term Care Insurance. This typically covers some of the cost of in-home care. However, benefits can vary depending on the plan, so you may need to review the policy to make sure it allows for non-medical services. It’s also important to note that early planning is key when it comes to long-term care insurance. Seniors over age 80 with chronic health conditions may not qualify for coverage.

- Life Insurance. It may be possible to convert a life insurance policy into a long-term care benefit plan, which will provide funds for in-home care. You might also be able to pay for care using a life insurance policy by taking a loan from the policy’s cash value or surrendering the policy in exchange for the cash value. Contact your insurance provider to learn what options are available.

- Savings & Retirement Accounts. Funds from an individual retirement account (IRA), can be used to help pay for home care. Many families pay for in-home home care services using a combination of individual retirement accounts, social security and personal savings.

- Reverse Mortgage. If there is equity in your loved one’s home, a reverse mortgage can be used to help pay for in-home care services. Seniors can generally borrow up to 70% of their home’s value and the loan does not have to be paid back until they sell the home, move out of the home, or pass away.

- Veteran’s Benefits. The Veterans Administration (VA) provides eligible veterans with benefits that can be used for in-home care services in place of nursing home care. Read more about home care benefits for veterans and the eligibility requirements here.

- In-Home Supportive Services (IHHS). The California IHSS Program provides non-medical care to elderly or disabled individuals who live at home. Program participants receive a set amount of money monthly to pay for care and are free to choose their own service provider. Learn more about the IHHS program here.

If you or your family member is considering in-home care as part of a plan to age in place, contact Family Matters In-Home Care today for a free consultation. Our team is dedicated to supporting your family and helping older adults enjoy life in the comfort of their own home for as long as possible.

Some of the services offered by Family Matter In-Home Care include: Alzheimer’s & Dementia Care, Bed & Wheelchair Transfer Assistance, Companionship, Housekeeping & Meal Preparation, Personal Care, Recovery Care, and Transportation.

Serving the San Francisco Bay Area and Greater San Diego, Family Matter In-Home Care has offices throughout California including: Campbell, CA, Roseville, CA, San Marcos, CA, and San Mateo, CA.