VA Pension Programs That Help Veterans with Long-Term Care

Over 1.5 million wartime service veterans and their surviving spouses are eligible for billions of dollars a year in VA pensions to help pay for long-term care such as assisted living, nursing home and home care. Many are not getting the benefits they are eligible for because they’re unaware of what programs are available and how to file an application.

These benefits are stacked programs, so in most cases you must be eligible for the Basic VA Pension in order to receive funds through the Aid & Attendance or Housebound Pensions. A veteran cannot simultaneously qualify for Aid & Attendance AND Housebound Pensions.

VA Pension Program Eligibility

First, review the following questions to see if you or your loved one meet these general, overarching eligibility requirements for receiving benefits through the VA. If you answer YES to all of the following, you may be eligible:

- Are you a veteran, a dependent of a veteran, or the surviving spouse of a veteran?

- Did you or your loved one participate in full-time, active military service other than active duty training as a member of the Army, Navy, Air Force, Marine Corps, Coast Guard, or as a commissioned officer of the Public Health Service, Environmental Science Services Administration or National Oceanic and Atmospheric Administration, or its predecessor, the Coast and Geodetic Survey?

- Were you or your loved one discharged under conditions other than dishonorable?

Keep in mind that, depending on your individual situation, additional guidelines such as age restrictions, medical needs, financial eligibility, disability status, enrollment in other benefits programs (such as Medicaid and Social Security), location, and insurance coverage may affect your eligibility.

In addition to the above, there are financial requirements and two other basic eligibility guidelines for all VA pensions:

- The veteran must have served at least 90 days of active service, and one of those days must have been during a period of VA-recognized wartime. He or she can have served anywhere in the world, including stateside. This designates the individual as a “wartime veteran.

- The periods of conflict that Congress recognizes for benefits are:

- World War II: 12/7/1941 to 12/31/1946

- Korea: 6/27/1950 to 1/31/1955

- Vietnam (if served in Vietnam): 2/28/1961 to 5/7/1975

- Vietnam (if served outside Vietnam): 8/5/1964 to 5/7/1975

- Gulf War: 8/2/1990 to present (total active duty must be 24 mo.)

- The periods of conflict that Congress recognizes for benefits are:

- The veteran must be 65 years of age or older OR permanently and totally disabled.

The Basic Veterans Pension

This benefit is a needs-based program that provides eligible veterans and their families with supplemental income.

Eligibility

The veteran must meet at least one of the following criteria in addition to basic eligibility requirements outlined above:

- Must be 65 years of age or older with limited or no income; OR

- Must be receiving Social Security Disability Insurance; OR

- Must be a patient in a nursing home; OR

- Must be permanently and totally disabled; OR

- Must be receiving Supplemental Social Security Income.

Since the Basic Pension is needs-based, the VA takes into account the veteran’s annual countable income, family composition and medical expenses when calculating financial eligibility and their monthly pension amount.

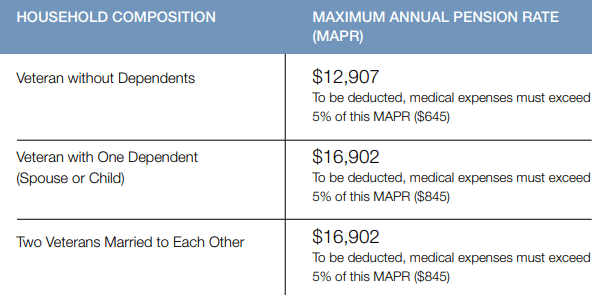

Congress sets a Maximum Annual Pension Rate (MAPR) each year, which also functions as the maximum income cap for eligible veterans. For 2017, a single veteran’s countable household income must be less than $12,907 annually in order to be financially eligible. The MAPR is changed annually to reflect inflation if it is significant enough.

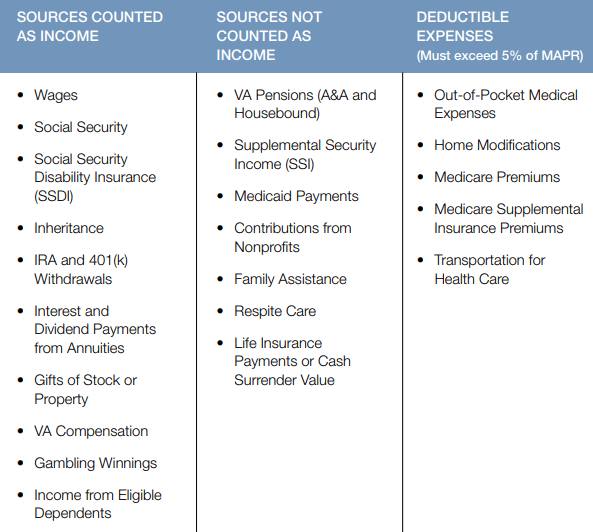

VA Income & Expense Classification

Deductible medical expenses can include a wide variety of products and services that most would not normally consider. For instance, incontinence supplies, medical alert devices and transportation expenses to and from doctor’s appointments are all legitimate deductions as long as the veteran pays for them out of pocket and is not reimbursed. Home care, home health care services and adult day care services are also fully deductible. However, these deductible medical expenses must amount to more than 5% of the veteran’s MAPR in order to begin reducing their countable income.

Pension Amounts

If the veteran meets all eligibility requirements explained in the previous pages, the VA will award the difference between their annual countable income and the MAPR in 12 monthly payments.

If your annual countable household income amounts to $7,207, the VA will subtract this income from the MAPR and award you this amount. $12,907 – $7,207 = $5,700

You would then receive $475 deposited into your bank account each month. $5,700 ÷ 12 = $475

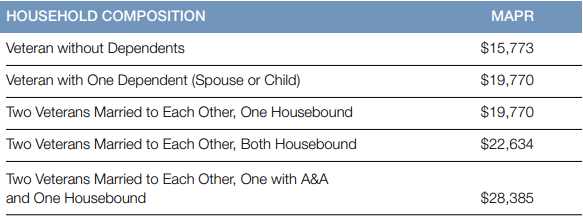

This baseline MAPR is adjusted according to the composition of the veteran’s household and increases if they are married and/or have dependent children living with them. Eligible dependent children must be under age 18, age 18-23 if attending a VA-approved school, or permanently incapable of self-support due to a disability that presented before age 18. The following table provides these adjusted MAPR amounts.

Maximum Annual Pension Rates for Veterans

The Aid & Attendance Improved Monthly Pension

The Aid & Attendance Pension, also known as A&A, is an ongoing, tax-free payment made to veterans or their surviving spouses. It’s a little-known stacked benefit comprised of Basic Pension, Housebound Pension and Aid & Attendance funding. This distinction is important for some state Medicaid programs and may determine how much money a veteran can keep if they go on Medicaid. A&A funding is paid directly to the veteran, and they may use it to pay expenses as they choose.

A&A is also needs-based and is intended to help seniors pay for long-term care. It can be used for medical and non-medical home care, medical and non-medical care in independent living communities, and for care in assisted living and skilled nursing facilities. It is often used to fund in-home care, since the total pension amount may not cover all skilled nursing or assisted living costs.

This benefit may also be used to pay a family caregiver who is providing a veteran’s in-home care services. Getting the Aid & Attendance benefit to pay for family caregivers is not an easy task, though. There must be a personal care agreement in place, and payment for care must be initiated and thoroughly documented before an application can be made. Veteran families may wish to seek help from an elder law attorney who specializes in VA benefits to get the contract in place and pursue this form of payment.

Eligibility

There are two more qualifications for a veteran to get this benefit in addition to the ones discussed earlier:

- A veteran’s countable income cannot exceed the A&A MAPR assigned by Congress.

- The veteran must meet at least ONE of the following criteria:

- The veteran must have a doctor’s order that he or she needs help with the five activities of daily living (ADLs) that the VA allows; OR

- The veteran must be bedridden due to a disability (or disabilities), and not due to any prescribed treatment or convalescence; OR

- The veteran is a patient in a nursing home due to mental or physical incapacity such as dementia or Alzheimer’s disease; OR

- The veteran is blind or their eyesight is limited to a corrected 5/200 visual acuity or less in both eyes; OR

- The veteran has a concentric contraction of the visual field to five degrees or less.

Typically, a veteran must be eligible for the Basic VA Pension before they will be approved for A&A. However, if a veteran has considerable care needs and is ineligible for the Basic Pension solely due to excess income, they may still be eligible for A&A since it is based on a higher MAPR.

Pension Amounts

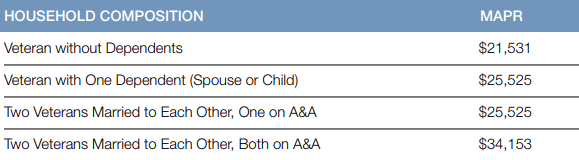

If the veteran meets all eligibility requirements explained in the previous pages, the VA will award the difference between their annual countable income and the MAPR in 12 monthly payments.

Maximum Annual Pension Rates for Aid & Attendance

The Housebound Increased Monthly Pension

The Housebound Increased Monthly Pension can be added to an eligible veteran’s Basic VA Pension when they are confined to their home or immediate premises due to a permanent disability.

This increased monthly payment is typically used to pay for unreimbursed long-term care. Like Aid & Attendance, the Housebound Pension can be used to pay for in-home care, assisted living, independent living, and nursing home care.

For example, if a veteran can manage his or her own activities of daily living, but requires oxygen therapy, has difficulty walking, and has no license, he or she has a considerable burden physically and financially when it comes to venturing outside. The Housebound Pension can help pay for transportation costs and other assistance necessary for such a veteran to engage in day-to-day activities both inside and outside the home.

Eligibility

The veteran must prove that they have significant difficulty getting around and are generally unable to leave their home. This evidence is typically provided in the form of a statement written by an attending physician.

Pension Amounts

If the veteran meets all eligibility requirements explained in the previous pages, the VA will award the difference between their annual countable income and the MAPR in 12 monthly payments.

In the following table, you will find the Housebound Pension MAPR adjusted for household composition.

Maximum Annual Pension Rates for Housebound Pension

Once you have decided that you or a loved one might be eligible to receive VA benefits, you will need to file a formal application. This process can be extremely lengthy and confusing, but being informed and prepared can help things go more smoothly. For more direction & guidance, contact the Family Matters In-Home Care office closest to you today!

If you or your family member is considering in-home care as part of a plan to age in place, contact Family Matters In-Home Care today for a free consultation. Our team is dedicated to supporting your family and helping older adults enjoy life in the comfort of their own home for as long as possible.

Some of the services offered by Family Matter In-Home Care include: Alzheimer’s & Dementia Care, Bed & Wheelchair Transfer Assistance, Companionship, Housekeeping & Meal Preparation, Personal Care, Recovery Care, and Transportation.

Serving the San Francisco Bay Area and Greater San Diego, Family Matter In-Home Care has offices throughout California including: Campbell, CA, Roseville, CA, San Marcos, CA, and San Mateo, CA.

Sources:

- https://lifeworkx2021.com/wp-content/uploads/2019/05/AgingCare-Veterans-Benefits.pdf